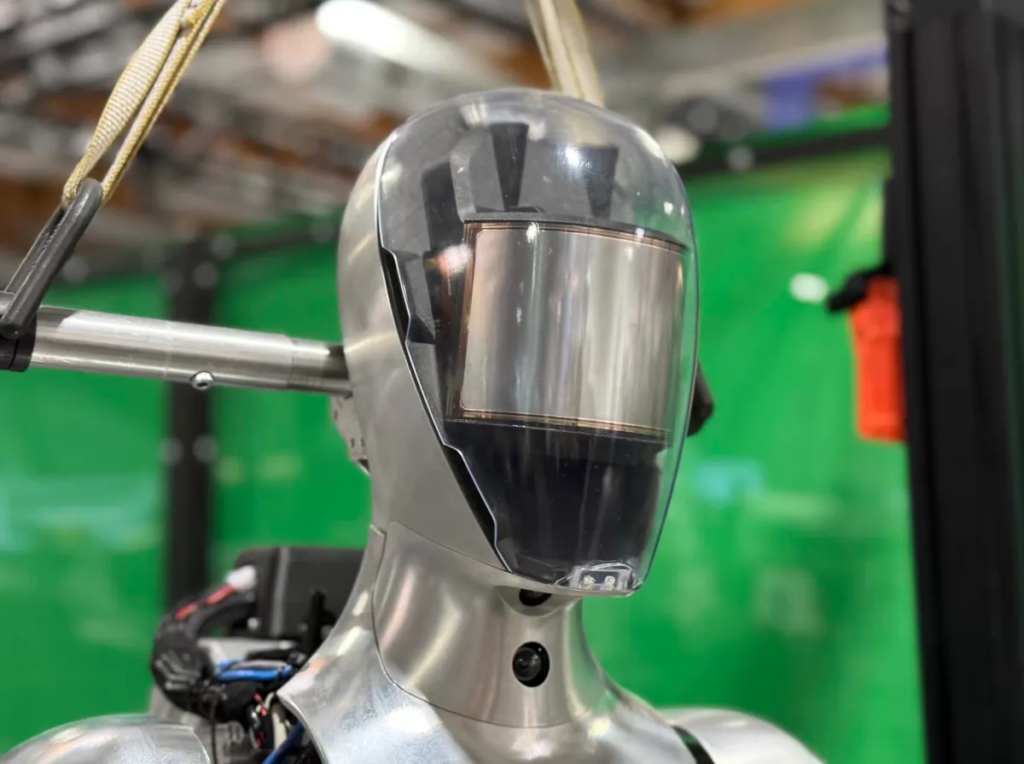

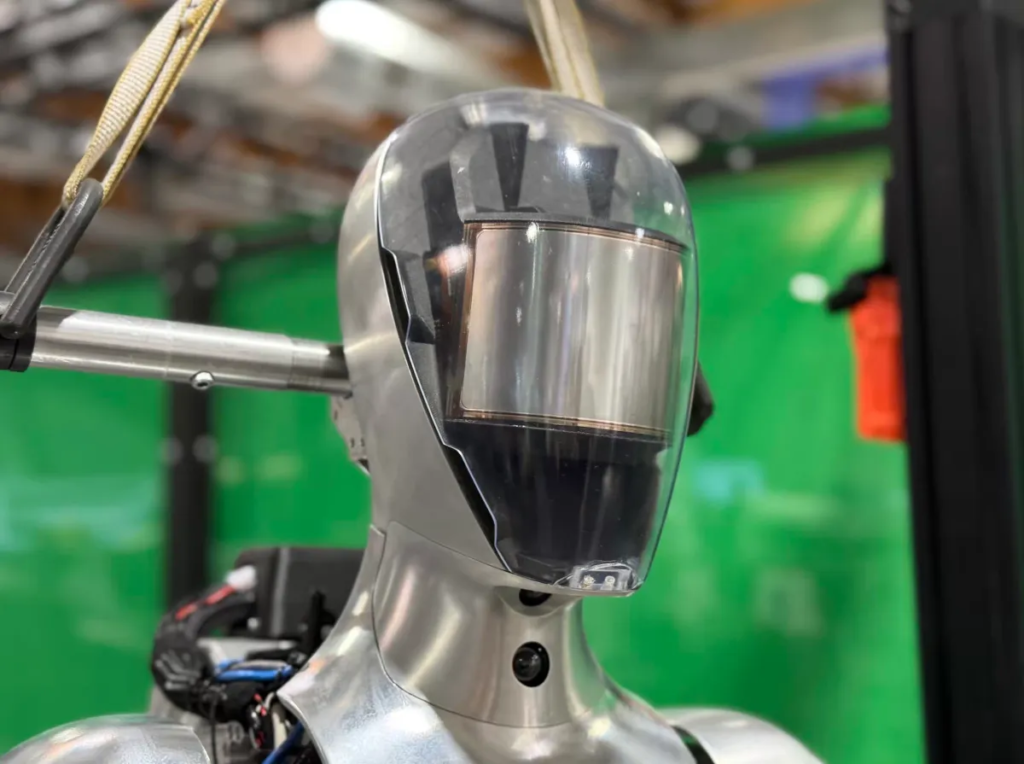

Figure AI, a company striving to introduce general-purpose humanoid robots for both commercial and residential applications, announced on X that it is ending its collaboration with OpenAI in favor of its own in-house AI development. The Bay Area-based robotics firm cited a “major breakthrough” in AI as the primary reason for this shift. While details remain scarce, founder and CEO Brett Adcock assured Techfulnews that Figure AI will unveil a groundbreaking humanoid AI advancement within the next 30 days.

Strategic Shift Away from OpenAI

OpenAI has played a notable role in Figure AI’s journey, previously collaborating on next-generation AI models for humanoid robots. In 2023, Figure AI secured $675 million in funding, bringing its valuation to $2.6 billion. To date, the company has raised $1.5 billion from investors, highlighting the immense financial backing behind its ambitious projects.

The decision to sever ties with OpenAI is unexpected, given the latter’s dominant position in artificial intelligence. Simply being associated with OpenAI typically offers companies a significant visibility boost. Just last August, Figure AI confirmed that its Figure 02 humanoid would utilize OpenAI’s models for natural language interactions.

The Challenge of Integration

Despite OpenAI’s expertise in AI-driven applications, Adcock pointed out that the integration process posed serious challenges. OpenAI operates on a massive scale, focusing primarily on general AI applications rather than embodied AI, which integrates artificial intelligence into physical systems such as robots. According to Adcock, vertical integration is the key to successfully scaling humanoid robotics.

“To solve embodied AI at scale in the real world, you have to vertically integrate robot AI,” Adcock told Techfullnews. “We can’t outsource AI for the same reason we can’t outsource our hardware.”

OpenAI’s Expanding Interest in Humanoid Robotics

Interestingly, OpenAI has been diversifying its investments in humanoid technology. The company is a major backer of 1X, a Norwegian robotics startup that focuses on humanoids for home applications. While many humanoid robot firms target industrial and warehouse automation, 1X has pivoted toward residential use cases.

Furthermore, OpenAI’s latest trademark application, filed with the U.S. Patent and Trademark Office (USPTO), suggests an interest in humanoid robotics. The filing references “user-programmable humanoid robots” and “humanoid robots with communication and learning capabilities”, fueling speculation that OpenAI might be developing its own hardware.

Figure AI’s Focus: Industry Over Homes

Although Figure AI has explored residential applications for its robots, its primary focus remains industrial deployments. This strategy aligns with automakers’ greater financial resources for testing and implementing emerging technologies. BMW, for example, began deploying Figure robots at its South Carolina factory in 2023, marking a significant milestone for the company.

The Competitive Landscape: Proprietary AI vs. Partnerships

The robotics industry remains divided on whether to develop proprietary AI models or rely on external partnerships. While Figure AI is doubling down on in-house development, other leading humanoid firms continue collaborating with AI specialists.

For instance, Boston Dynamics has partnered with the Toyota Research Institute to enhance its Atlas humanoid robot with advanced AI capabilities. The approach mirrors Apple’s vertically integrated ecosystem, where software is optimized specifically for proprietary hardware. However, achieving seamless hardware-software synergy is both complex and resource-intensive.

The Road Ahead for Figure AI

With its deep financial backing, Figure AI has been able to rapidly scale its hardware and software teams, recently relocating to a larger Bay Area office to accommodate its growth. The company’s shift away from OpenAI marks a pivotal moment in its mission to redefine humanoid robotics through proprietary AI models.

The next 30 days will be crucial, as Figure AI promises to showcase a technological advancement that has never been seen on a humanoid robot. If successful, this move could position the company as a leader in the humanoid robotics space, setting a new standard for vertically integrated AI-powered robots.