Meta is betting big, perhaps too big, on artificial intelligence. As the global race to build AI infrastructure heats up, the social media giant is investing billions into what it believes will define the next era of computing. But as Wall Street’s latest reaction shows, not everyone is buying it.

The company, whose chief executive is Mark Zuckerberg, is constructing two giant data centers in the U.S. as part of a wider AI expansion. U.S. tech companies collectively will invest as much as $600 billion in infrastructure over the next three years, according to estimates from industry insiders, with Meta as one of the biggest spenders.

But as Silicon Valley celebrates the AI boom, investors are asking one question: whether Meta’s spending spree is sustainable, let alone strategic.

Earnings Reveal Soaring Costs — and Investor Doubts

Meta’s latest quarterly report showed a sharp rise in costs: operating expenses were up $7 billion year over year and capital expenditures rose nearly $20 billion, largely driven by the acquisition of AI infrastructure and talent. The company generated $20 billion in profit for the quarter, but investors focused on the ballooning expenses — and the lack of clear AI monetization.

During the earnings call, Zuckerberg defended the aggressive spending.

“The right thing is to accelerate this — to make sure we have the compute we need for AI research and our core business,” he said. “Once we get the new frontier models from our Superintelligence Lab (MSL) online, we’ll unlock massive new opportunities.”

But the reassurance didn’t land. Meta’s stock sank 12% by Friday’s close, wiping out more than $200 billion in market value within days.

Big Spending, Small Returns (For Now)

While Meta isn’t alone in its AI splurge – Google, Microsoft, Nvidia, and OpenAI are also spending billions on computing – the key difference is in the results. Google and Nvidia are already experiencing strong revenue growth thanks to AI, while OpenAI, although much more risky, has one of the fastest-growing consumer products in history, generating around $20 billion a year.

But Meta has yet to introduce the blockbuster AI product that would seem to justify the astronomical spending.

Its flagship Meta AI assistant reportedly serves over a billion users, but this is largely a factor of its embedding across Facebook, Instagram, and WhatsApp rather than organic adoption. Analysts say it still lags far behind in functionality and brand strength compared to competitors such as ChatGPT and Claude.

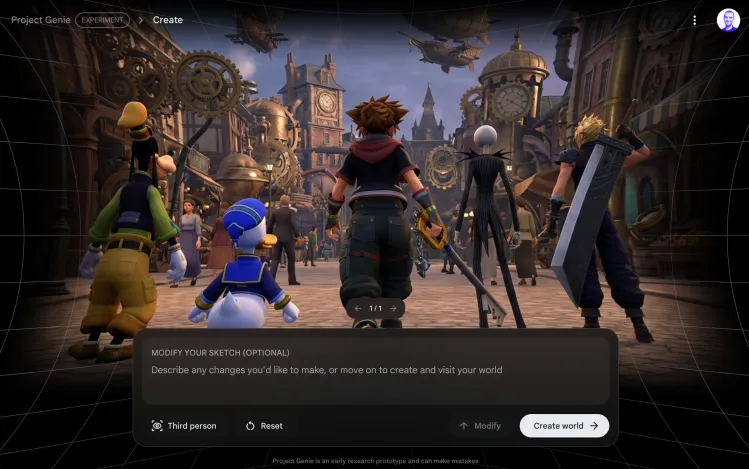

Meanwhile, Meta’s Vibes video generator, which gave the company a fleeting bump in engagement, has yet to prove its commercial viability. And while the Vanguard smart glasses it introduced with Ray-Ban do hold some promise for combining AI and augmented reality, they’re still more prototype than core business driver.

Zuckerberg’s Vision: Superintelligence and the Future

Undeterred by the skepticism, Zuckerberg insists Meta’s AI ambitions are only just getting started. He said the company’s Superintelligence Lab, or MSL, is working on next-generation “frontier models” that will power classes of products entirely new.

“It’s not just Meta AI as an assistant,” Zuckerberg said. “We expect to build new models and products — things that redefine how people and businesses interact with technology.”

Yet, he didn’t provide any details or timelines-a thing that frustrated analysts, who wanted some concrete projections. The promise of “more details in the coming months” wasn’t enough to calm investor nerves.

The AI Bubble Question

A massive infrastructure build-out at Meta has revived fears that the technology industry might be inflating yet another bubble. With tens of billions of dollars pouring into GPUs, data centers, and AI labs, some analysts warn that valuations in the sector are running ahead of tangible outcomes.

Yet, others argue that Meta’s financial position gives it more room to experiment. Unlike many AI startups, Meta still has a profitable advertising empire to fall back on. Its 3 billion monthly active users across its apps provide an unmatched data advantage — if it can find a compelling AI use case.

Where Does Meta Go From Here?

The direction of the company is not determined. Fundamental strategic questions are still hanging:

Will Meta use its vast personal data ecosystem to challenge OpenAI and Anthropic directly?

Does it want to integrate AI-powered advertising and business tools for enterprises?

Or will it shift to immersive consumer products, merging AI with AR/VR in the metaverse?

For now, those answers remain elusive. One thing is for sure: Zuckerberg is playing the long game, one that could either solidify Meta’s role in the next era of computing or turn into one of Silicon Valley’s most expensive miscalculations. As the AI arms race accelerates, Meta’s challenge isn’t just to build smarter machines — it’s to convince investors, and the world, that the company still knows where it’s going.