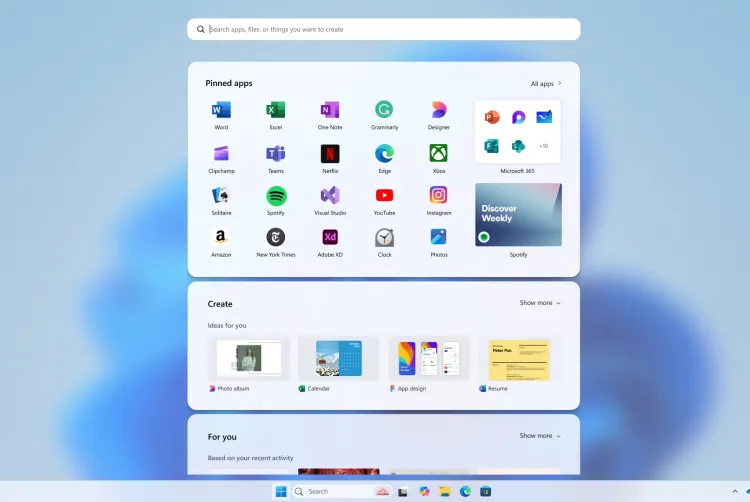

Microsoft is rolling out a significant redesign of the Windows 11 Start menu this month, introducing a wider layout and—most notably—the ability to disable the recommended feed of files and apps. While the new design is already a departure from the current version, Microsoft recently shared unseen concept images that reveal even more radical ideas that were considered during development.

Exploring Microsoft’s Start Menu Concepts

In a behind-the-scenes blog post, Microsoft’s design team unveiled five early prototypes that could have completely transformed how users interact with the Start menu. These concepts ranged from widget-like interfaces to full-screen landing pages, showcasing Microsoft’s willingness to experiment before settling on the final design.

Key Concept Designs That Almost Made the Cut

- Widget-Inspired Start Menu

- Featured a more rounded design with a dedicated “For You” section displaying Teams meetings, YouTube videos, and recent files.

- Resembled a personalized dashboard, blending productivity and entertainment.

- Sidebar-Centric Layout

- Separated the “For You” recommendations into a side panel.

- The main section focused on app categories for quicker navigation.

- Full-Screen Landing Page

- Turned the Start menu into a comprehensive hub with shortcuts, apps, files, and even Android phone integration.

- Included personalized app lists and creative tools for power users.

- Vertical Scrolling Menu

- Occupied the entire screen height, with distinct scrollable sections.

- Aimed to maximize space for pinned apps, recent documents, and quick actions.

Microsoft’s design team emphasized that no idea was too bold during the brainstorming phase. They used whiteboards, Figma mockups, and paper prototypes to explore every possibility before refining the final version.

User Feedback Shaped the Final Design

Microsoft didn’t just rely on internal testing—over 300 Windows 11 enthusiasts participated in trials, including co-creation calls with select users. The team analyzed:

- Eye-tracking heatmaps to see where users focused.

- Scroll behavior to optimize navigation.

- Audible reactions (like excited “oh!” moments) to gauge engagement.

The goal was to balance innovation with familiarity, ensuring the new Start menu remained fast, customizable, and intuitive without disrupting decades of user muscle memory.

What’s New in the Final Start Menu Design?

The upcoming Start menu in Windows 11 brings several key improvements:

✔ Wider, More Spacious Layout – Easier to browse apps and files.

✔ Disable Recommended Feed – No more forced suggestions.

✔ Enhanced Phone Integration – Quick access to recent calls, messages, and mobile files.

✔ Better Customization – More control over pinned apps and layout.

When Will the New Start Menu Roll Out?

Microsoft is currently testing the redesign with Windows Insiders, with a public release expected in the coming months. This update marks one of the most significant visual and functional changes to the Start menu since Windows 11’s launch.

Final Thoughts: A More User-Centric Windows Experience

By blending user feedback with bold experimentation, Microsoft is refining Windows 11’s Start menu to be more flexible and less intrusive. The ability to turn off recommendations alone will be a major win for productivity-focused users, while the new layout ensures smoother access to essential tools.

Stay tuned for the official release—this could be the most user-friendly Start menu yet!